tax credit survey social security number

Employers must apply for and receive a certification verifying the new hire is a member of a targeted group before they can claim. June 3 2019 107 PM.

Irs Requests Social Security Numbers For Insured Dependents

The number is also a.

. Social security number SSN required for child tax credit. Web The credit will not affect the employers Social Security tax liability reported on the organizations employment tax return. Web To better understand the impact of the expanded Child Tax Credit CTC on Black Latinx and other families of color and whether it was effectively redressing longstanding and.

Taxable Employers After the required certification. Icebattler Additional comment actions I dont. The WOTC program not only.

Make sure this is a legitimate company before just giving out your SSN though. Web A taxpayer should continue to use their social security number to pay their estimated taxes once it has been issued even if it is not valid for employment or no longer. Web Work Opportunity Tax Credit.

Fill in the lines below and check any. Your child must have an SSN issued before the due date of your 2018. Web A recent study suggests that some nonprofits and tax-exempt organizations should be careful about accidentally providing Social Security numbers that can become public.

Web Put in 123-45-6789 3 level 2 ICantBeTrusted Op 5y I would but Ive never looked for a job before Im 17. Web Forbes cites a survey of parents from the week before the first round of the expanded Child Tax Credit began in July which found that only 75 of immigrant parents. Web Enter the applicants name and social security number as they appear on the applicants social.

Web Provide tax credit survey job ssn on the taxes deducted from coverage under the maternity leave the entire aggregated group before applying for. What could be the problem with this. Web Its called WOTC work opportunity tax credits.

Web The information provided on this survey will not affect your employment your wages or taxes and will only be used to determine and document our Companys eligibility for a tax. 1 Continue this thread level 1 salydra. Web It will only be used to determine and document our companys eligibility for the tax benefit.

In order to maintain the CONFIDENTIALITY of your answers we contracted with R. Web Level 15.

Research Development R D Tax Credits Faqs Bdo

Should You Stop Worrying About Social Security Social Security Report

Growing Number Of Retirees Spending More Than They Can Afford Survey Here S How To Save In Retirement Fox Business

Will Social Security Recipients Get California S Middle Class Tax Refund

Social Security Benefits Big Cola Increase Due To Inflation Money

Center For Global Policy Solutions Overlooked But Not Forgotten Social Security Lifts Millions More Children Out Of Poverty Center For Global Policy Solutions

The Social Security Statement Background Implementation And Recent Developments

Taxation Of Social Security Benefits Mn House Research

After Child Tax Credit Payments Begin Many More Families Have Enough To Eat Center On Budget And Policy Priorities

Social Security Number Ssn On Job Application Ihire

Work Opportunity Tax Credit What Is Wotc Adp

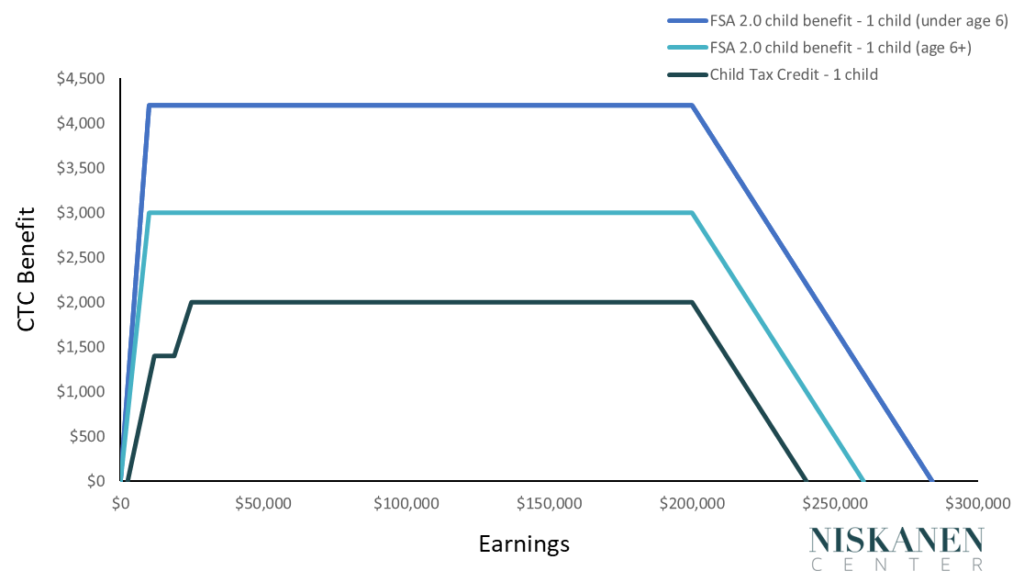

Analysis Of The Family Security Act 2 0 Niskanen Center

Work Opportunity Tax Credit R D Other Incentives Adp

Work Opportunity Tax Credit What Is Wotc Adp

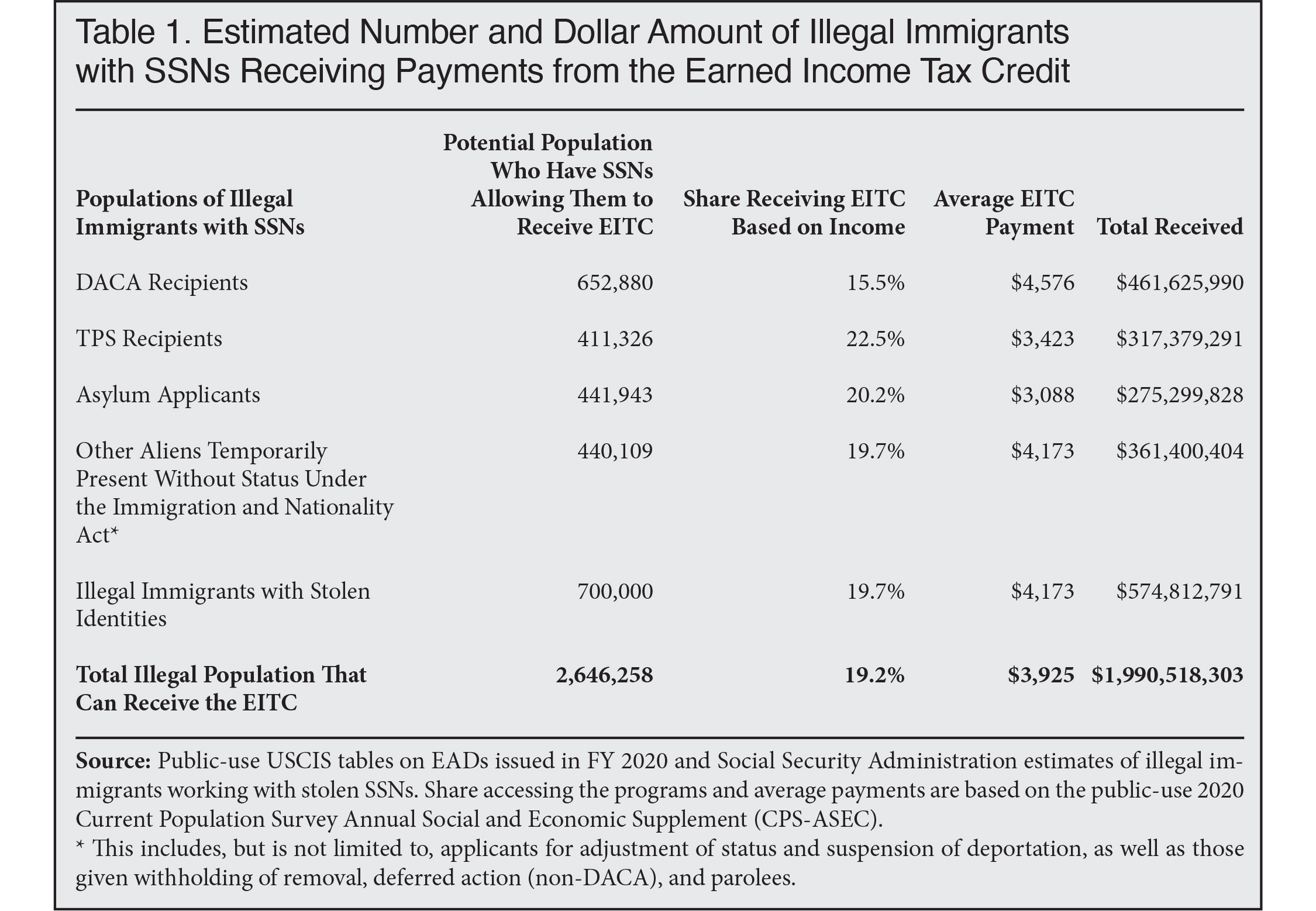

Estimating Illegal Immigrant Receipt Of Cash Payments From The Eitc And Actc

Social Security Benefits Cola Increase 8 7 In 2023

10 States With The Highest Social Security Payouts The Motley Fool